Swap. Provide Liquidity. Earn Fees.

A governance-driven DEX on Base with integrated multichain swaps.

Features Overview

Swap assets across 50+ networks with aggregated routing.

Stable, volatile and concentrated pools with governance-driven emissions.

Lock VRT to vote and receive 100% of trading fees.

Earn pool rewards and external governance incentives.

How It Works

Use Virtus Swapper to access Base liquidity from any network

Supply assets into governance-aligned pools

Direct emissions through protocol gauges

Mint veVRT to vote and receive trading fees

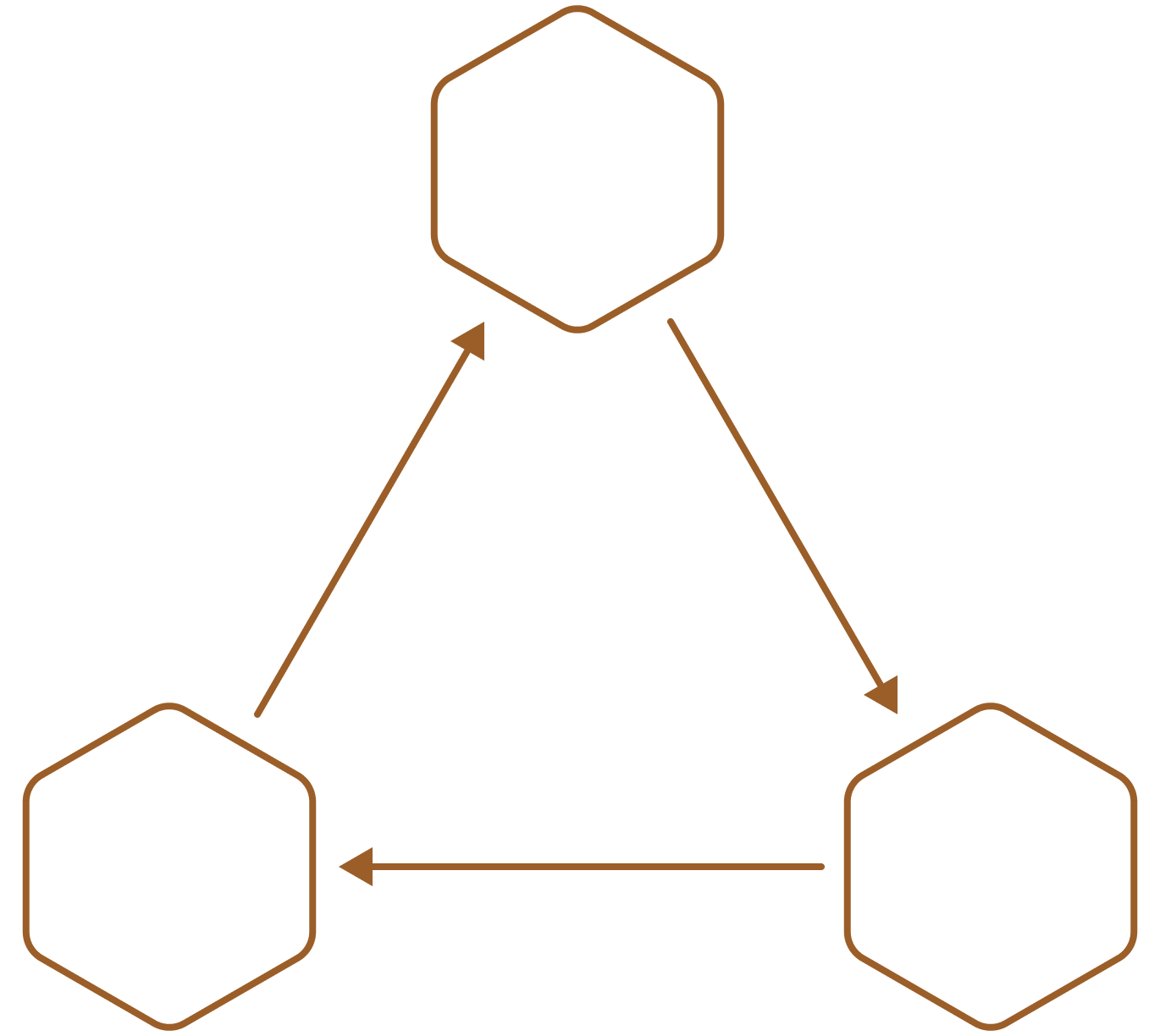

How Value Flows

Lock VRT to vote on pool emissions.

veVRT holders receive a share of trading fees.

LP providers receive VRT emissions.

Built on Base. Connected Across Chains.

Virtus combines a governance-driven liquidity protocol with integrated multichain swaps, allowing capital to move efficiently while liquidity remains aligned with protocol growth.

Built on audited veDEX smart contract architecture, deployed without core modifications.